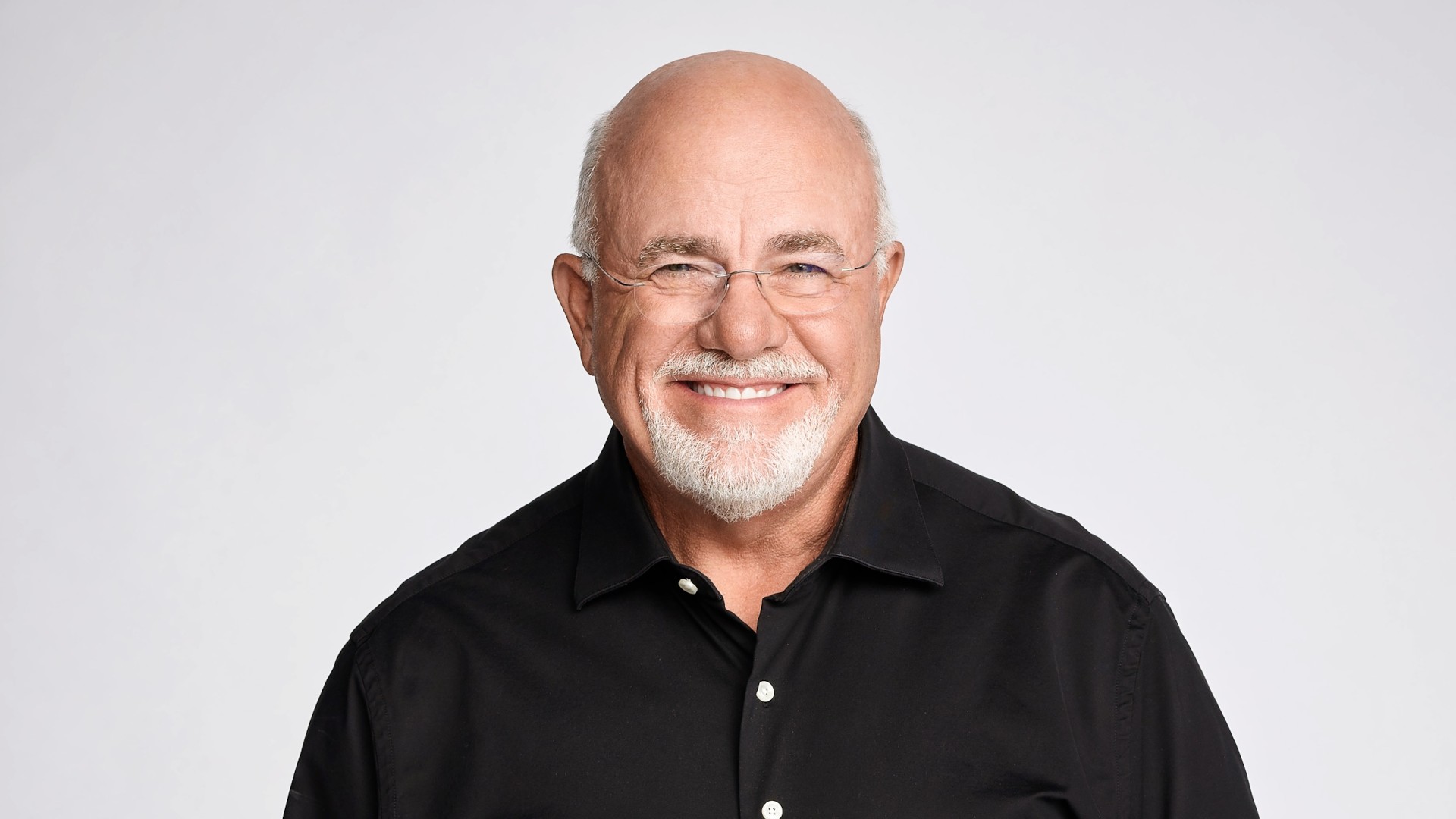

Financial expert Dave Ramsey offers six actionable steps to pay off your mortgage faster, a strategy increasingly relevant with rising interest rates and homeowner debt. These tips aim to reduce financial stress, free up income, and build wealth more efficiently.

1. Increase Mortgage Payments

Making extra payments—even small ones—significantly reduces the total interest paid and accelerates payoff. For a $220,000, 30-year mortgage at 4%, adding one extra quarterly payment shaves 11 years and nearly $65,000 off the loan. Bi-weekly payments (half the mortgage every two weeks) simulate an extra monthly payment, saving $24,000 and four years. Rounding up payments or allocating raises/bonuses to the principal can also yield substantial savings.

2. Cut Daily Spending

Small daily expenses add up. Bringing lunch to work saves around $1,200 annually, which could pay off a mortgage three years earlier and save $28,000 in interest. Eliminating daily coffee runs ($90/month) saves $25,000 in interest and reduces the loan by four years.

3. Simulate a Shorter Loan Term

Refinancing to a 15-year mortgage accelerates payoff and reduces interest, but it isn’t always feasible. Instead, make payments as if the mortgage were a 15-year loan. This aggressive approach frees up monthly income sooner for retirement, education, or other goals.

4. Downsize Your Home

Selling a current home with equity and using the profits to buy a smaller, cheaper one can eliminate or drastically reduce the mortgage. Even if a new mortgage is needed, a smaller balance means faster payoff. Avoid VA loans if possible; they are often more expensive than conventional options.

5. Use a Trusted Real Estate Professional

Working with a knowledgeable real estate agent saves time and money by negotiating the best deal. Ramsey’s Endorsed Local Provider (ELP) network connects homeowners with trusted professionals who prioritize their financial interests.

6. Maximize Your Down Payment

Putting down 20% avoids private mortgage insurance (PMI), which typically costs 0.5%–1% of the loan amount annually. While 100% down isn’t always possible, maximizing the initial payment minimizes the financed amount and accelerates payoff.

Final Take: Before buying, ensure financial readiness: no debt, 3–6 months of expenses saved, ability to cover down payments and closing costs, housing costs at 25% or less of net income, and affordability of a 15-year fixed-rate mortgage and ongoing maintenance.